Vueron Newsletter

No. 92

2024.02.23

| Hyundai Motor, Kia set up joint lab with KAIST | ||

| Uber Eats to begin self-driving robot deliveries in Japan | ||

| LG Innotek hastens to lead autonomous driving solution | ||

| Chinese driverless AI firm Westwell to invest HK$300 million to attract research talent for new Hong Kong headquarters |

1. Hyundai Motor, Kia set up joint lab with KAIST

-

- Hyundai Motor and Kia have partnered with KAIST to develop next-generation autonomous driving sensors.

- They are establishing the Hyundai Motor Group-KAIST On-Chip LiDAR Joint Research Center at the KAIST main campus.

- The collaborative lab will operate for four years until 2028, with over 30 researchers involved.

- Objectives include advancing production technology for high-performance, compact on-chip sensors and developing innovative signal detection technologies.

- On-chip sensors integrate functions using semiconductor technology, enabling downsizing of LiDAR systems and cost-effective mass production.

- Next-generation signal detection technology uses ‘frequency modulated continuous wave’ concept to minimize signal noise and eliminate interference from external light sources.

- Hyundai Motor, Kia, and Hyundai NGV will oversee lab operation and provide technological support, while KAIST will handle research aspects like developing small on-chip LiDAR components, fabricating high-speed integrated circuits, and optimizing LiDAR system designs.

The focus on on-chip sensors and signal detection technologies suggests a move towards more integrated and efficient autonomous driving systems. Leveraging semiconductor technology for LiDAR systems points towards a trend of increasing miniaturization and cost-effectiveness in this field.

2. Uber Eats to begin self-driving robot deliveries in Japan

-

- Uber Eats is partnering with Mitsubishi Electric and Cartken to introduce self-driving robots for food delivery in Japan.

- The sidewalk robot deliveries are scheduled to commence by the end of March in a specific area of Tokyo.

- This marks Uber Eats’ first international expansion of its autonomous delivery operations, previously limited to a few U.S. cities.

- Cartken, founded in 2019 in Oakland, California, by former Google employees, will provide its “Model C” robot fleet, capable of navigating autonomously and approaching human walking speed.

- Mitsubishi Electric will oversee the operations in Japan.

- The collaboration aims to redefine the future of food delivery, emphasizing accessibility and sustainability.

- Uber Eats and Cartken already offer sidewalk robot deliveries in Miami and Fairfax, Virginia, and have partnered with other robotics companies for autonomous delivery pilots in the U.S.

This move aligns with broader industry trends toward automation and robotics in logistics and delivery services, driven by the desire for efficiency, cost-effectiveness, and reduced reliance on human labor. Collaborations between food delivery platforms and robotics companies indicate a growing interest in leveraging technology to address last-mile delivery challenges and improve customer experience.

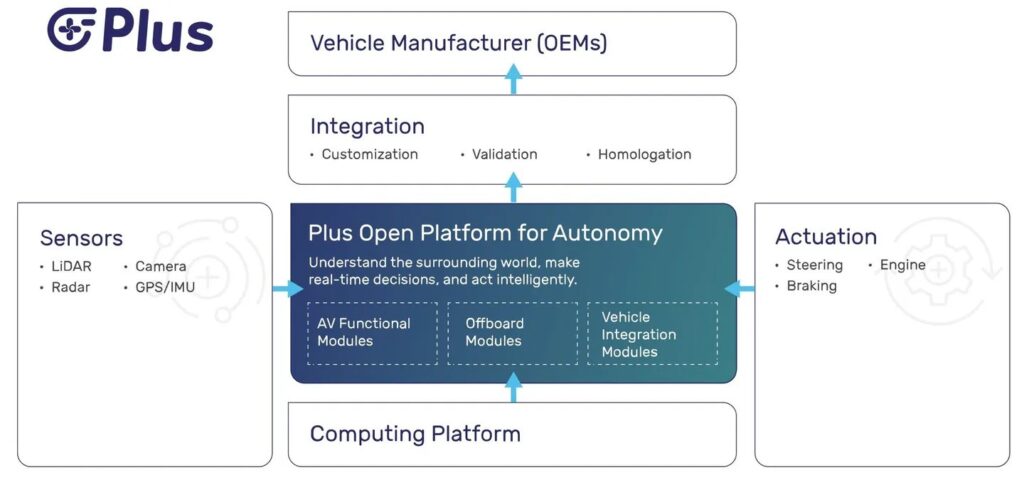

3. Plus Introduces “Open Platform For Autonomy” To Scale AV Use Cases

-

- Plus has introduced the Open Platform for Autonomy (OPA), a modular software platform powered by AI models, aiming to support various levels of autonomy with customized solutions.

- The company, based in Santa Clara, California, collaborates with leading global OEMs and Tier 1s, including Bosch, IVECO, and Luminar, among others, to bring autonomous driving solutions to the market.

- OPA aligns with the trend of scaling up self-driving technologies in the automated trucking space, alongside efforts by other companies like Gatik and Aurora.

- Shawn Kerrigan, COO and Co-Founder at Plus, emphasizes OPA’s flexibility, performance, and scalability, positioning it as a game-changer for the industry.

- OPA allows customization of smart vehicle tech across different components like sensors, processors, platforms, and powertrains, enabling rapid integration of autonomous driving capabilities.

- Plus’s Level 4 capability is considered the “DNA” of OPA, with solutions like PlusDrive® (L2++) and SuperDrive™ (L4) already in commercial use and testing phases.

- OPA aims to facilitate the scaling of PlusDrive and seamless transition between autonomy levels, supporting OEMs’ software-defined vehicle strategies.

- The platform offers over-the-air software updates for continuous improvement and expansion of features, aligning with the evolving needs of customers in the vehicle industry.

- Unlike early AV startups retrofitting trucks, Plus’s OPA targets traditional players, emphasizing smooth integration and flexibility in implementation for full-scale adoption.

By partnering with established industry players, Plus aims to accelerate the adoption of autonomous driving solutions and support the transition towards higher autonomy levels. This move highlights the maturation of the Autonomous Vehicle industry, with a focus on collaboration and integration within the traditional automotive ecosystem, rather than solely targeting startups and retrofitting existing vehicles.

4. LG Innotek hastens to lead autonomous driving solution

-

- LG Innotek, a major camera module supplier from South Korea, aims to reduce reliance on Apple and expand into the autonomous driving technology market.

- They unveiled a new camera module with a direct heating system for Advanced Driver Assistant Systems (ADAS), which thaws frost, snow, or ice faster and consumes less power.

- ADAS cameras rely on clear lenses, making reliable performance crucial, especially in hazardous weather conditions.

- The company plans to lead the self-driving camera module market, anticipating rapid growth, with the global vehicle camera module market projected to reach $10.03 billion by 2030.

- LG Innotek’s heating technology is energy-efficient, using up to 4 watts of energy while thawing lenses in half the time compared to conventional methods.

- Positive Temperature Coefficient (PTC) materials enable self-regulating temperature, preventing overheating and allowing faster obstruction removal without damaging the lens.

- The company aims to mass-produce the new heater-integrated camera module by 2027, offering design flexibility for vehicle integration.

- To reduce reliance on Apple, LG Innotek focuses on diversification, investing in sectors like vehicle camera modules and extended reality (XR) gears.

- LG Innotek also acquired stakes in AOE Optronics Co., enhancing their partnership to strengthen their position in the global automotive camera module market.

This diversification strategy positions LG Innotek to capitalize on emerging opportunities in the automotive industry and reduce vulnerability to fluctuations in demand from individual customers like Apple.

5. Chinese driverless AI firm Westwell to invest HK$300 million to attract research talent for new Hong Kong headquarters

-

- Westwell, a Chinese AI chip developer for driverless vehicles, plans to invest HK$300 million in its new HQ in Hong Kong over five years.

- The investment aims to create 500 jobs, with 70% in R&D.

- Westwell’s flagship product is the Q-Truck, an autonomous commercial vehicle.

- After fundraising rounds in 2023, Westwell is valued at 7 billion yuan.

- It’s expanding globally, collaborating with Hutchison Ports in Thailand and the UK’s Port of Felixstowe.

- Hong Kong’s status as a hub for finance and government support for innovation influenced Westwell’s decision to establish its HQ there.

- The Hong Kong government supports Westwell’s overseas expansion and views it as a reflection of the city’s booming tech industry.

- Westwell looks forward to collaborating with Hong Kong’s universities to research and apply AI and autonomous vehicle technologies.

Westwell focuses on research and development, with 70% of new jobs allocated to R&D. Hong Kong’s government support and industry collaboration facilitate this expansion, aligning with the city’s ambition to become a leading tech hub.

*Contents above are the opinion of ChatGPT, not an individual nor company