Vueron Newsletter

No. 93

2024.02.27

| Backed by Chinese carmaker Great Wall, Haomo raises $14M for autonomous driving tech | ||

| GM’s Cruise to resume robotaxi tests on city roads in coming weeks, Bloomberg reports | ||

| Nuro gets a leg up from Arm in launching its third-generation delivery robot | ||

| Aroot enters AI and autonomous driving power semiconductor market with acquisition of NSRC |

1. Backed by Chinese carmaker Great Wall, Haomo raises $14M for autonomous driving tech

-

- Autonomous driving companies in China are facing a slowdown in investment after a period of intense funding.

- Haomo.ai, an autonomous driving startup backed by Great Wall Motor, raised $14 million in the first tranche of its Series B funding led by Chengdu Wufa Private Equity Fund Management, supported by the Chengdu government.

- Domestic investors, particularly those with local government funding, are stepping up to support emerging tech companies in China as foreign venture capital firms retreat.

- Haomo.ai has raised over $200 million in yuan-denominated equity funding, with investors including Meituan and Qualcomm Ventures.

- Led by CEO Gu Weihao, Haomo.ai focuses on developing Level 2 advanced driver assistance systems (ADAS) for passenger cars, primarily for Great Wall, and Level 4 self-driving solutions for logistics vehicles, with clients including Meituan, Alibaba, and JD.com.

- The investment from Chengdu ties Haomo to an agreement to develop robotics for Wuhou district, leveraging the district’s desire to become a national tech showcase.

- Haomo’s ADAS solutions have powered over 20 vehicle models and accumulated 120 million kilometers of driving, while its self-driving delivery vans have transported close to 300,000 grocery parcels in Beijing.

- Haomo competes with other Chinese AV startups such as Pony.ai, WeRide, Momenta, and Deeproute, most of which initially aimed to develop robotaxis but have shifted focus to less advanced, deployable L2 or L3 products.

- Haomo’s partnership with Great Wall provides stable revenues for R&D and allows it to supply ADAS to multiple OEMs without being restricted to one customer.

Partnering with local governments can provide access to government incentives, infrastructure support, and potential regulatory assistance, which are crucial for scaling up autonomous driving technologies.

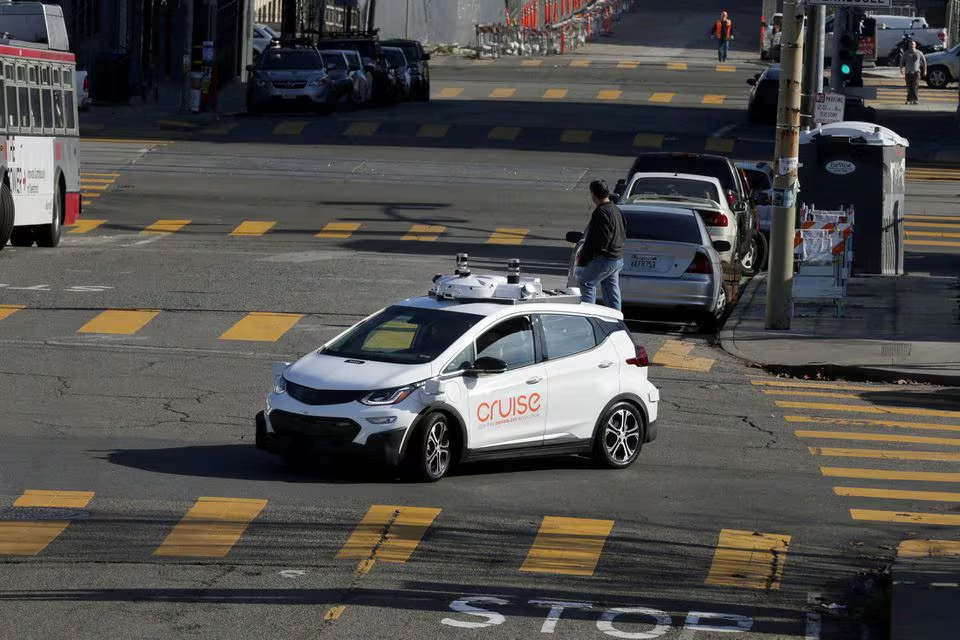

2. GM’s Cruise to resume robotaxi tests on city roads in coming weeks, Bloomberg reports

-

- General Motors’ self-driving car unit, Cruise, plans to resume testing its robotaxis with safety drivers on public roads in Houston and Dallas in the coming weeks.

- Cruise suspended its U.S. operations in October following an incident in San Francisco, where one of its robotaxis was involved in an accident with a pedestrian.

- Cruise aims to rebuild trust with regulators and the public before relaunching its services. They plan to start with manually driven vehicles and supervised testing in one city.

- The company is engaging with officials in potential markets to gather information, provide updates, and rebuild trust.

- Cruise is considering restarting testing with as few as 10 cars in each city, without passengers, as reported by Reuters.

- Recent accidents involving self-driving taxis from GM and Alphabet’s Waymo have prompted calls for stricter regulation of autonomous vehicles.

- In January, Cruise disclosed investigations by the U.S. Justice Department and the Securities and Exchange Commission into the October accident involving its robotaxi.

Cruise’s decision to resume testing indicates its commitment to advancing autonomous driving technology despite setbacks. This move suggests confidence in addressing safety concerns and navigating regulatory challenges.

3. Stellantis CEO says there’s still life in Waymo deal for self-driving delivery vans

-

- Stellantis and Waymo are deepening their partnership to focus on commercial self-driving Ram delivery vans, originally announced in 2020 but faded from public view.

- Discussions on the improved deal include challenges around driverless delivery, particularly regarding parcel handover at the destination.

- Stellantis CEO Carlos Tavares hints at an upgraded collaboration with Waymo, emphasizing the need to address logistical hurdles while also teasing further engineering possibilities.

- Tavares expects to share more details, possibly by summer, indicating ongoing negotiations and development.

- Waymo confirms its interest in deepening the relationship with Stellantis but refrains from sharing further details or progress.

- The partnership revival suggests both companies are invested in exploring autonomous delivery opportunities despite past challenges in such collaborations.

- However, executing the broader deal presents real challenges, particularly for Waymo, which primarily focuses on scaling its robotaxi service and has yet to operate a commercial delivery service using its self-driving vehicles.

- Stellantis and Waymo have been partners since 2016, initially supplying custom Chrysler Pacifica Hybrid minivans for Waymo’s autonomous driving technology.

- While the partnership initially aimed for significant vehicle orders, Waymo received fewer minivans than anticipated, yet the program played a critical role in its commercialization efforts.

- Waymo replaced the Chrysler Pacifica program with all-electric Jaguar I-Pace vehicles for its robotaxi service, indicating a shift in vehicle choice for autonomous operations.

Despite the current focus on delivery vans, both companies likely have broader long-term visions for their partnership. This could involve exploring additional opportunities in autonomous transportation beyond just delivery services, potentially encompassing other forms of mobility or even broader applications in various industries.

4. Nuro gets a leg up from Arm in launching its third-generation delivery robot

-

- Nuro, a delivery robot company, partners with chip designer Arm to develop its third-generation vehicle, enhancing capabilities and fast-tracking production of its delivery service.

- The partnership leverages Arm’s Automotive Enhanced technology for Nuro Driver, powering hardware and software for autonomous delivery vehicles, focusing on safety and specialized computing needs.

- Amid safety concerns and dwindling investment in autonomous vehicles, Nuro proceeds with its third-generation R3 vehicle, aiming for twice the cargo space, modular inserts, and temperature-controlled compartments.

- By deepening its relationship with Arm, Nuro aims to boost the efficiency and range of its R3 robot by up to 20% without altering battery size, utilizing Arm’s low-power technology for AI-driven decision-making.

- Nuro, founded in 2016 by Google self-driving car project veterans, operates fully driverless vehicles in California and Texas, with over 1 million miles traveled autonomously.

- While Nuro’s software stack runs on Arm’s technology, its powertrain is developed by China’s BYD, with plans to manufacture next-generation vehicles in Nevada.

- Although Nuro faced challenges last year, including pausing commercial expansion and delaying R3 production due to cost issues, it is conducting small-scale commercial pilots and planning service expansion.

- Nuro sees potential beyond delivery, including passenger vehicles, but delivery remains its core focus, making the Arm deal crucial for scaling production and achieving mass production readiness.

Nuro’s focus on improving efficiency and scalability through the Arm deal underscores its dedication to overcoming technical hurdles and achieving mass production readiness. By optimizing power efficiency and reducing costs, Nuro aims to make its autonomous delivery service commercially viable on a large scale.

5. Aroot enters AI and autonomous driving power semiconductor market with acquisition of NSRC

-

- Aroot has completed the acquisition of a stake in NSRC, a semiconductor equipment specialist, marking its entry into the power semiconductor market.

- Aroot plans to inject funds into NSRC to facilitate new business initiatives, capitalizing on NSRC’s growth trajectory, with an average rate of 47% over the past three years, amid a booming industry.

- The surge in demand for power semiconductors, driven by the artificial intelligence (AI) industry, particularly in data centers, necessitates optimizing power consumption for rapid data processing.

- In autonomous vehicles, power semiconductors play a crucial role in enhancing power efficiency, contributing to weight reduction and improved performance. NSRC is a key provider of refurbished semiconductor exposure equipment, vital in the production of power semiconductors.

- The exposure process in semiconductor manufacturing accounts for a significant portion of production time and costs, indicating increasing demand for equipment as the semiconductor industry becomes more active.

- Aroot’s acquisition of a 70% stake in NSRC for $16.8 billion positions the company to leverage NSRC’s growth potential, with profit margins exceeding 20%.

- With Aroot’s management capabilities and funding, NSRC aims for sales exceeding 40 billion won and an operating profit of 10 billion won this year, targeting both domestic and international markets.

Aroot’s acquisition of NSRC reflects its strategic move to tap into the lucrative power semiconductor market, driven by the growing demand for semiconductors in AI and autonomous vehicles. This expansion diversifies Aroot’s portfolio and positions it for growth in key emerging sectors.

*Contents above are the opinion of ChatGPT, not an individual nor company